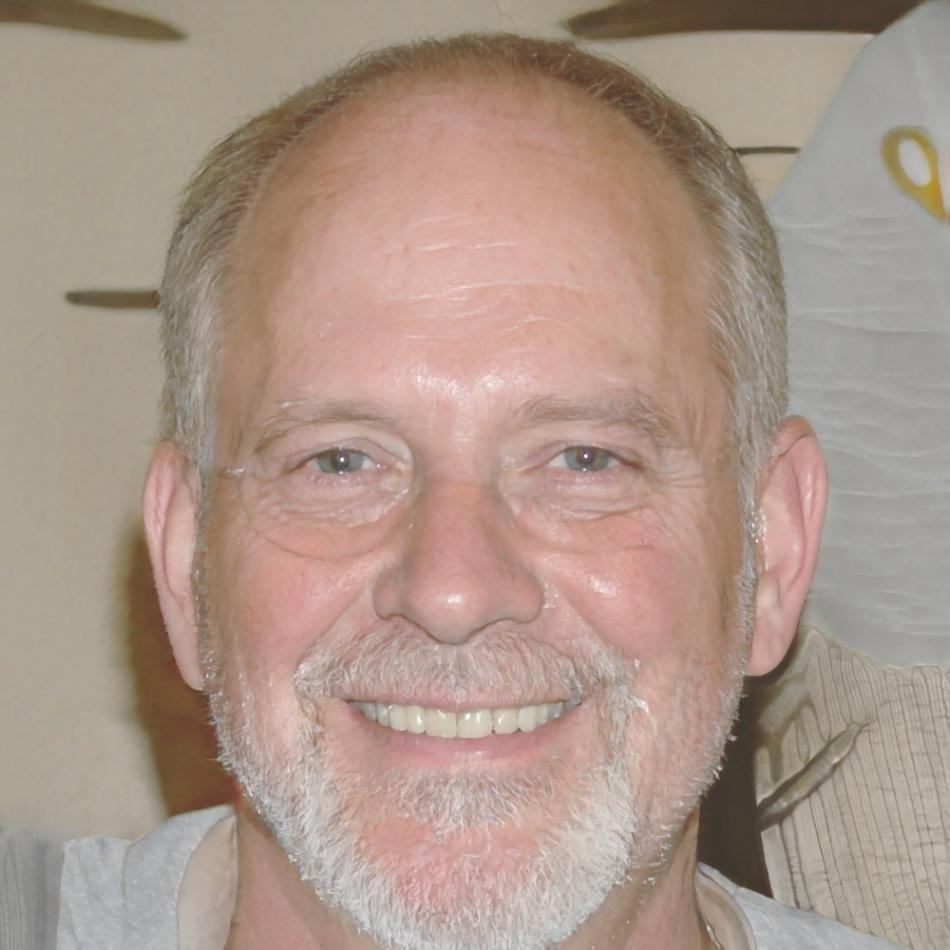

Jasper Thornwell

Retail Manager, Brisbane

Jasper was frustrated watching his savings lose value while interest rates climbed. He knew something was wrong but couldn't connect the dots between policy changes and his bank account.

Now he tracks CPI releases like weather reports and adjusted his savings approach to account for real inflation rates. Still not thrilled about rising costs, but at least he understands the game.